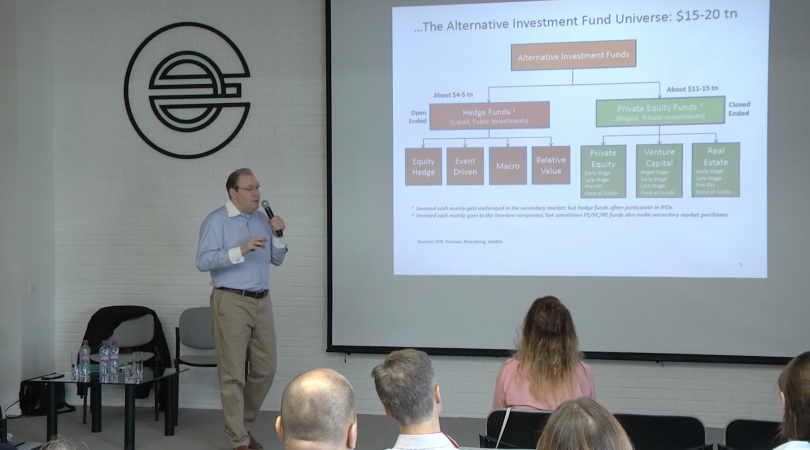

On May 30, 2019, the INFINITUM group held a seminar Alternative Investments and Feasibility of Setting Up a Fund Abroad. An investment fund is conventionally considered to be one of the most conservative methods of capital management and is usually opposed to active types of asset management, specifically trading or entrepreneurship. However such a rather primitive perception of investment as a passive management of assets has nothing to do with real business that, apart from conventional investment instruments, i.e. securities and bank deposits, deals with a considerable layer of investment culture referred to as alternative investments.

Mikhail Boboshko, an independent consultant on funds establishment, Co-managing Director, Head of Research of the Moscow Hedge Fund Managers Club, Chairman of the Hedge Fund Committee of the National Alternative Investment Management Association (NAIMA), spoke about subjects and objectives of alternative investments, main challenges and specifics of setting up public and private funds abroad. Mikhail also shared his experience of setting up a fund in which assets are objects of art. Ksenia Podoinitsyna, an expert on the Russian contemporary art market, read an interesting lecture about how to analyze an artist’s investment appeal, in line with what Mikhail Boboshko had previously said.

The topic evoked keen interest of the audience, which proves that management companies are ready to open new investment opportunities for themselves and their clients. A complete video of the seminar will be available on our web-site in the near future.

“ Packaging various investment strategies — both liquid and illiquid — into investment funds is one of the most convenient formats for an investor and a manager. It is very important to understand that a “fund” is not just a separate legal entity, but a bunch of contractors - an administrator, broker, a law firm, a bank and an auditor. It is their competent interaction that provides a well-coordinated mechanism for the operation of an investment fund. Understanding these fundamentals is the first step in managers building their international business, and for the investor - it is the ability to quickly conduct due diligence of the proposed product”, - commented on the event Evgeniya Slouchak, partner and head of the branch of EPFC Group in Armenia.